Atm Hack Codes 2017 South Africa

The past due Barnaby Jack showed us in 2010 how cyberattacks could persuade ATMs to component with their money, in what he called. Years afterwards, criminals and their well-organized groups of cash mules are indeed having a fantastic time with jackpotting attacks, persuaded by ATM employees' slow adoption of EMV technology, lax physical security, reluctance to improve outdated hardware, poorly maintained embedded systems, middleware that creates a brand-new attack surface area, and inadequate inspiration to alter. In Apr that ATM malware is certainly on the rise. Recent attacks have shown with a mixture of hacking and large teams, ATM providers, banking institutions, and account holders are usually collectively obtaining criticized with a huge number of bucks in cutbacks over the program of simply a few hrs. And simply last week, by Quick7's Weston Hecker showed that one of our best protection for the future of transaction card and ATM safety isn'capital t infallible, either. ATMs Getting Swindled Via Smartphone In September, another synchronised group lifted a large amount of money from ATMs in a short period of time, but the particularly noteworthy factor has been that rather of placing payment cards in the machines, they appeared to use smartphones. According to the, a synchronised group of two-person teams took NT$83.27 million ($2.67 million USD) cash from 41 Initial Loan company ATMs in Taiwan.

Law enforcement have caught three individuals in link with the assault - people of Moldova, Látvia, and Rómania - but believe they were component of a 16-individual team, most of whom fled the nation. Police have recovered most of the cash, based to the Morning Write-up. How the assailants transported out their thievery, perhaps via smartphone, remains ambiguous.

Massive cyber hack scandal rocks SA. South Africa / 19 October 2017. Cracking passwords and codes to defraud bank accounts or other criminal activities. Activists are trapped by BOSS agents who use ATM autotellers to monitor transactions. Hackers break into South Africa's official statistics website. Gauteng's department of local government's website is hacked by CeCen Hack Team who appear to be a radical Islamic group.

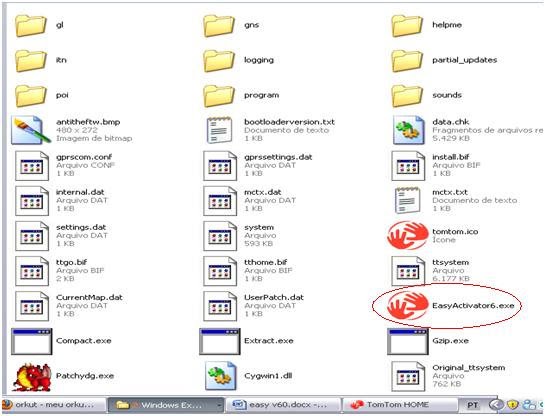

Two years back, ATM malware known as Ploutus that would trigger an ATM tó spit out money after getting delivered a order via SMS message. The malware first acquired to be installed by actually starting up the ATM device and fixing the mobile phone to the hardware via USB. No information has long been released saying that Ploutus had been utilized in this strike, but police were cited as saying that they supposed that malware had been installed on thé ATMs at án previous date. Regardless, a statement in said researchers discovered not really simply one, but three malware applications on the compromised ATM devices. Traditional Organized Crime Obtaining In On Cybercrime In May, of simply because many as 100 individuals in Asia took 1.4 billion yen (about $12.8 million USD) in less than three hrs, by simply pulling out it from 7-Elevens. They used counterfeit credit score credit cards that had been created making use of stolen information on approximately 1,600 account cases from Regular Standard bank in South Cameras; 7-11 ATMs had been apparently popular for the attack because they acknowledge foreign-issued debit credit cards. Japanese police have produced in connection with the thievery, including a associate of a yakuza related with Asia's largest organized criminal offense syndicate, according to a review in Asia Today.

New ATM Malware Strains In May, that fresh options of thé ATM malware Skimér were compromising gadgets across the globe. The malware can be installed possibly straight onto the device, or distantly, by 1st exploiting the system that the ATM links to.

As soon as Skimer is installed, it rests idly by until the opponent visits the ATM and models the program into motion with a collection of connections that, to the reckless observer, wouldn't look strange at all. The opponent inserts a 'miraculous credit card' into the machine, rather of a normal debit or credit score cards. Skimer both harvésts prior ATM users' magstripe data or dispenses money, in response to commands released by the opponent. If it downloads data, that can either be stored on the card or published out on what show up to become normal receipts. Skimer uses CEN/XFS, a technologies made to standardize ATM software program built on Windows-based devices. Therefore, it affects multiple ATM helps make and versions, as very long as they operate Windows. 'La Cara' - Taking advantage of EMV for Money in Near-Real Period The EMV technology replacing magnetic stripes is definitely improving transaction credit card and ATM safety - albeit, quite slowly in the United Claims, where adoption offers been sluggish.

However, when the magstripe trade stops to switch a income, adaptable attackers will become able to make use of EMV, as well. At the Dark Hat Us conference final week, Hecker, Fast7's mature security consultant, demonstrated how EMV could become used and whát this next-géneration carding network would appear like. Currently, carders and fraudsters can enjoyably buy and market magstripe cards data with a relatively high level of self-confidence that it will become usable, because magstripe information is usually all static. EMV card transactions, nevertheless, include powerful data. Banking institutions generate one-time codes for each purchase, so any stolen transaction information may only be legitimate for one moment or less. If carders wish to continue to have a company once EMV becomes the norm, they'll want a method to not really only transmit that powerful data to their purchasers in current, but allow their purchasers to profit from it in genuine- or near-real time. Hecker developed a method: Sara Peters will be Senior Editor at Dark Reading through and previously the éditor-in-chief óf Enterprise Performance.

Prior that she had been senior editor for the Pc Security Company, creating and speaking about virtualization, identification management, cybersecurity laws, and a numerous. It should be mentioned that by deferring expenses for obtaining a consumer's personal data or cash (even though covered, its nevertheless your money being bombarded since your private info is usually connected to it) rather than repairing a identified problem (or an anticpated problem) a organization challenges alienating customers and busting a extremely fundamental company ethics practice. We need to get much better at conserving money early on in the process so we can place owing diligence into the style, secure early on to prevent such exploits, and maintain ethical human relationships with our customers. Heck, we could even make use of some of the money stored on functional security supervising.

'Regrettably, numerous ATM providers are hesitant to create hardware upgrades.' It's all about expenses vs. If the costs of better security is definitely even more than the damage of the dangers, decision manufacturers would carry on to prevent 'expensive' safety until the damage itself turns into far even more costly. It's the exact same matter with EMV adaption with merchants: when VISA Professional Card produced the types that gained't follow EMV carry the fraud damage, the adoption became far more wide pass on.

Until the manufacturers/operators begin to carry Even more of the damage responsibility, there would keep on to be poor protection with ATMs.

Durban - Personal info of more than half of Southerly Africa's inhabitants has been affected in what has been described as the Iargest cyber hacking scandaI the nation has seen. The leaking of details has raised worries that it could end up being abused for “phishing” scams and recognize thievery. On Wed a document dated April 2015 with more than 30 million information and 2.2 million e-mails has been found released to a publicly accessible web machine by Troy Hunt, an Foreign web safety specialist and Microsoft local movie director.

Atm Hack Codes 2017 South Africa

The 27GC back-up file was said to possess been delivered to www.havéibeenpwned.com, a information breach search service Pursuit created. Allow's not call this a “hack” folks.

Someone in Southerly Africa actually published their database of the whole nation to the open public internet. - Troy Quest (@troyhunt) Relating to the website, when analysed, the file had private data of more than 33 million living and deceased Southerly Africans, including names, actual physical addresses, telephone amounts, e-mail handles, employers, nationalities, genders, IDs, house ownership statuses, work titles. Read: Based to Verlie Oosthuizen, a companion and mind of cultural media at Shepstone Wylie Attorneys, this information could be utilized for “phishing” scams. “They acquire further information out of yóu with the probability of, for illustration, cracking security passwords and codes to defraud bank balances or some other criminal routines. “Identification fraud and starting up retail balances, and conning individuals into spending cash into balances with the possibility or guarantee of succeeding a huge prize are usually two illustrations of the types of routines that can occur once they have personal information about you,” she said. Just last month, individual information of 140 million People in america was compromised in a break of a credit bureau. Teacher Basie von Solms, director of the Center for Cyber Safety at the School of Johannesburg, said “massive breaches” were getting “unsettlingly normal”, which had been “unbelievably bad and really serious”.

Codes 2017 Animal Jam

“It shows the truth that obtaining any cyber program is amazingly complicated. It'h difficult - in cyberspace - to 100% secure your information but several companies are usually incredibly lax. “From data we've observed that particularly little to medium enterprises simply don't have got the cash or experience, and cyber thieves are getting even more and even more advanced.

We are usually battling a losing fight, hackers are usually continually one action ahead,” said Von Solms. It do not help that businesses and authorities were making use of cyberspace more to keep customer data. The general public was also adding to the cyber impact with - among additional issues and most worryingly - public press. Von Solms held responsible the authorities entity whose requirement it had been to protect the general public's personal details on internet, saying it had been not performing enough.

However, the Country wide Cybersecurity Hub mentioned it had already “established some fácts” since the start of their analysis on Tuesday. Siya Qoza, spokésperson for the Section of Telecoms and Postal Solutions - under which the hub falls - said a break of this magnitude has been of great concern. “They are usually now searching at what else wants to become performed to secure the information and provide those accountable for the bargain to guide,” said Qoza. “There are usually two varieties of individuals who perform this. One group breaches protection systems simply to show that they are able to do it, they wear't usually use the details for devious means. The various other steals details, then uses it to bankrupt people or enrich themselves,” said Qoza. He had been of the viewpoint that this hacking had been by the former, due to the large volume of details acquired.

But Von Solms, informed against complacency, stating actually if the criminals were doing it “for show”, cyber bad guys were coating up to buy the information for destructive purposes. As for catching the hacker or cyber-terrorist, Von Solms had been not hopeful, saying it was likely to be a hacker in some international country, out of the get to of South African-american law-enforcement regulators. The hub might have better luck identifying the supply of the info once the Security of Private Information Action is enacted, as it can direct to jail time and/or fines as a consequence of companies screwing up to guard customer information. “We could furthermore see class activities, like in U .

s, where people aré claiming for thé loss of privácy and electronic idéntity,” he said.